All Categories

Featured

Table of Contents

Plan ends up being convertible to a whole life policy between the ages of 22 to 25. A handful of variables affect how much final expenditure life insurance you absolutely require.

A full declaration of insurance coverage is discovered only in the policy. There are restrictions and problems relating to repayment of benefits due to misrepresentations on the application or when fatality is the result of suicide in the initial 2 plan years.

Returns are not ensured. Long-term life insurance develops cash money worth that can be obtained. Plan fundings accrue interest and unsettled policy financings and passion will reduce the survivor benefit and money worth of the policy. The quantity of money value offered will usually depend on the sort of permanent plan acquired, the quantity of coverage bought, the length of time the policy has been in force and any kind of impressive policy finances.

State Regulated Final Expense Program

State Farm manufacturers do not offer tax or lawful guidance. Additionally, neither State Ranch neither its manufacturers offer investment advice, other than in specific limited situations associating to tax-qualified fixed annuities and life insurance plans funding tax-qualified accounts. Please consult your tax obligation or lawful expert regarding your specific situations. This policy does not ensure that its profits will be enough to spend for any kind of particular solution or product at the time of need or that solutions or merchandise will be provided by any certain company.

The most effective means to ensure the policy quantity paid is spent where planned is to name a recipient (and, in many cases, an additional and tertiary beneficiary) or to place your dreams in a making it through will and testament. It is often a good technique to alert main recipients of their expected responsibilities when a Last Cost Insurance plan is obtained.

It was developed to meet the requirements of senior adults ages 50 to 80. Premiums begin at $21 each month * for a $5,000 insurance coverage policy (premiums will differ based on problem age, gender, and coverage quantity). Additionally, rates and costs are assured not to enhance. No medical exam and no health concerns are required, and customers are assured insurance coverage through automated credentials.

Listed below you will find some frequently asked inquiries need to you pick to make an application for Final Expense Life Insurance Policy on your own. Corebridge Direct accredited life insurance policy agents are waiting to respond to any added questions you may have concerning the security of your enjoyed ones in the occasion of your death.

They can be used on anything and are created to assist the recipients prevent an economic situation when a loved one passes. Funds are usually used to cover funeral expenses, clinical expenses, repaying a home mortgage, vehicle financings, or even made use of as a savings for a brand-new home. If you have sufficient cost savings to cover your end-of-life expenses, then you might not need final cost insurance coverage.

Furthermore, if you've been not able to get approved for bigger life insurance policy policies because of age or medical conditions, a last expense policy may be a cost effective choice that decreases the concern positioned on your household when you pass. Yes. Final expenditure life insurance policy is not the only method to cover your end-of-life costs.

Funeral Policy Meaning

These normally offer greater coverage quantities and can protect your family's way of life as well as cover your last costs. Connected: Whole life insurance for elders.

The application process is quick and easy, and insurance coverage can be released in days, often also on the day you use. Once you've been accepted, your protection begins instantly. Your policy never ever runs out as long as your premiums are paid. Last expense policies can develop cash money worth in time. When the cash money value of your policy is high enough, you can withdraw cash money from it, utilize it to obtain cash, and even pay your premiums.

Top 10 Final Expense Insurance Companies

There are a variety of prices linked with a death, so having final expense protection is very important. A few of the basics covered consist of: Funeral setups, consisting of embalming, casket, flowers, and solutions Burial costs, consisting of cremation, funeral story, headstone, and interment Impressive clinical, legal, or charge card costs Once the funds have been paid out to your beneficiary, they can utilize the money any means they desire.

Just make certain you pick somebody you can trust to allocate the funds correctly. Progressive Responses - what is the difference between life insurance and final expense is your resource for all points life insurance policy, from exactly how it works to the sorts of plans offered

This fatality advantage is normally related to end-of-life costs such as medical expenses, funeral prices, and a lot more. Picking a last expense insurance policy option is one of the lots of actions you can require to prepare your household for the future. To help you better recognize the ins and outs of this type of whole life insurance policy policy, let's take a closer look at how last expense insurance policy works and the sorts of plans that might be available for you.

Not every final expenditure life insurance coverage plan coincides. Depending upon your health and just how much you are able to manage in costs, there is a plan option that is appropriate for you. Here are a few of the different survivor benefit kinds linked with a final expense policy. An immediate or standard final expenditure insurance coverage enables recipients to obtain full survivor benefit no matter when or just how the insurance holder passed away after the begin of the insurance policy.

A graded benefit plan might have it so that if the insured passes during the first year of the policy, up to 40 percent of the benefit will be given to the recipients. If the insured passes away within the second year, up to 80 percent of the benefits will most likely to the recipients.

Whole Life Funeral Insurance

An assured issue final expenditure insurance plan calls for a 2- to three-year waiting period prior to being qualified to get benefits. If the insured private die prior to the end of this waiting duration, the beneficiaries will not be qualified to get the survivor benefit. They may get a return of the premiums that have been paid with passion.

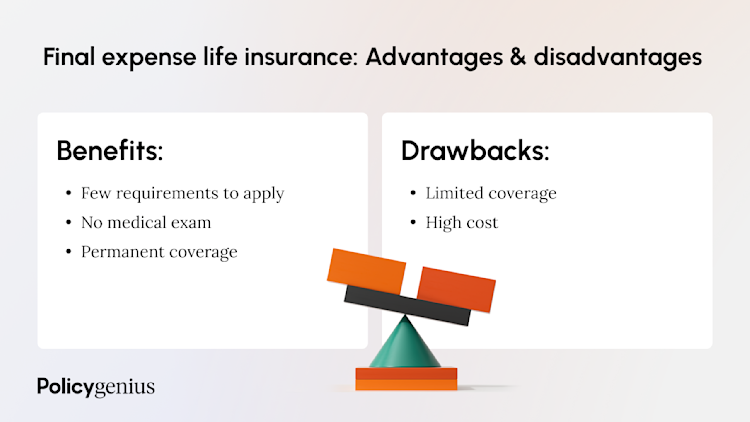

Depending upon your wellness and your finances, some plans may be far better matched for you and your family over the various other alternatives. In general, last cost life insurance policy is wonderful for any individual looking for an inexpensive plan that will certainly aid cover any exceptional equilibriums and funeral prices. The expense of premiums tends to be less than traditional insurance plan, making them quite affordable if you are seeking something that will certainly fit a tight budget.

Final Expense Insurance Commissions

An immediate final expenditure policy is a good alternative for anyone who is not healthy because beneficiaries are eligible to obtain benefits without a waiting period. A study on the health and clinical background of the insurance policy holder might identify how much the premium on this plan will be and affect the survivor benefit amount.

A person with significant health and wellness conditions could be denied other types of life insurance, but an ensured concern plan can still offer them with the coverage they need. Planning for end-of-life costs is never ever a satisfying conversation to have, however it is one that will help your family when encountering a hard time.

Aig Funeral Insurance

It can be uneasy to think concerning the costs that are left when we pass away. Failing to plan in advance for an expense may leave your family members owing hundreds of bucks. Oxford Life's Assurance final expense whole life insurance coverage plan is an affordable means to assist cover funeral prices and other expenditures left behind.

Latest Posts

Best Burial Insurance Policy

Final Expense Or Burial Insurance

Family Funeral Policy